Tokenomics

What is a tokenomics model?

It is a fusion of the terms "token" and "economics". Tokenomics serves as a comprehensive framework for understanding the factors that contribute to a cryptocurrency's value and appeal to investors.

This encompasses a range of elements, from the supply of the token and its issuance method to its specific use-cases.

Understanding tokenomics is crucial for an investor when evaluating a blockchain project. Purchasing and retaining tokens over an extended period are generally more sustainable and successful if the project has a well-developed and well-planned token ecosystem.

A robust platform often leads to increased demand over time, attracting new investors and subsequently driving up prices.

Similarly, when initiating a new project, founders and developers must meticulously assess the tokenomics of their native digital currency to ensure it draws investment and achieves success.

Key Aspects of Tokenomics

The economic architecture of a cryptocurrency defines the incentives that motivate investors to acquire and hold a particular coin or token. The most important aspects are Token Allocation and Vesting Periods.

Many cryptocurrency initiatives have a well-defined plan for the allocation of tokens. Frequently, a designated quantity of tokens is set aside for stakeholders like venture capitalists or developers. However, the caveat is that these tokens can only be liquidated after a specified duration.

This, in turn, influences the coin's circulating supply over time. The optimal scenario is when a project's team has devised a distribution strategy that minimizes the impact on both the circulating supply and the token's market value as much as feasible.

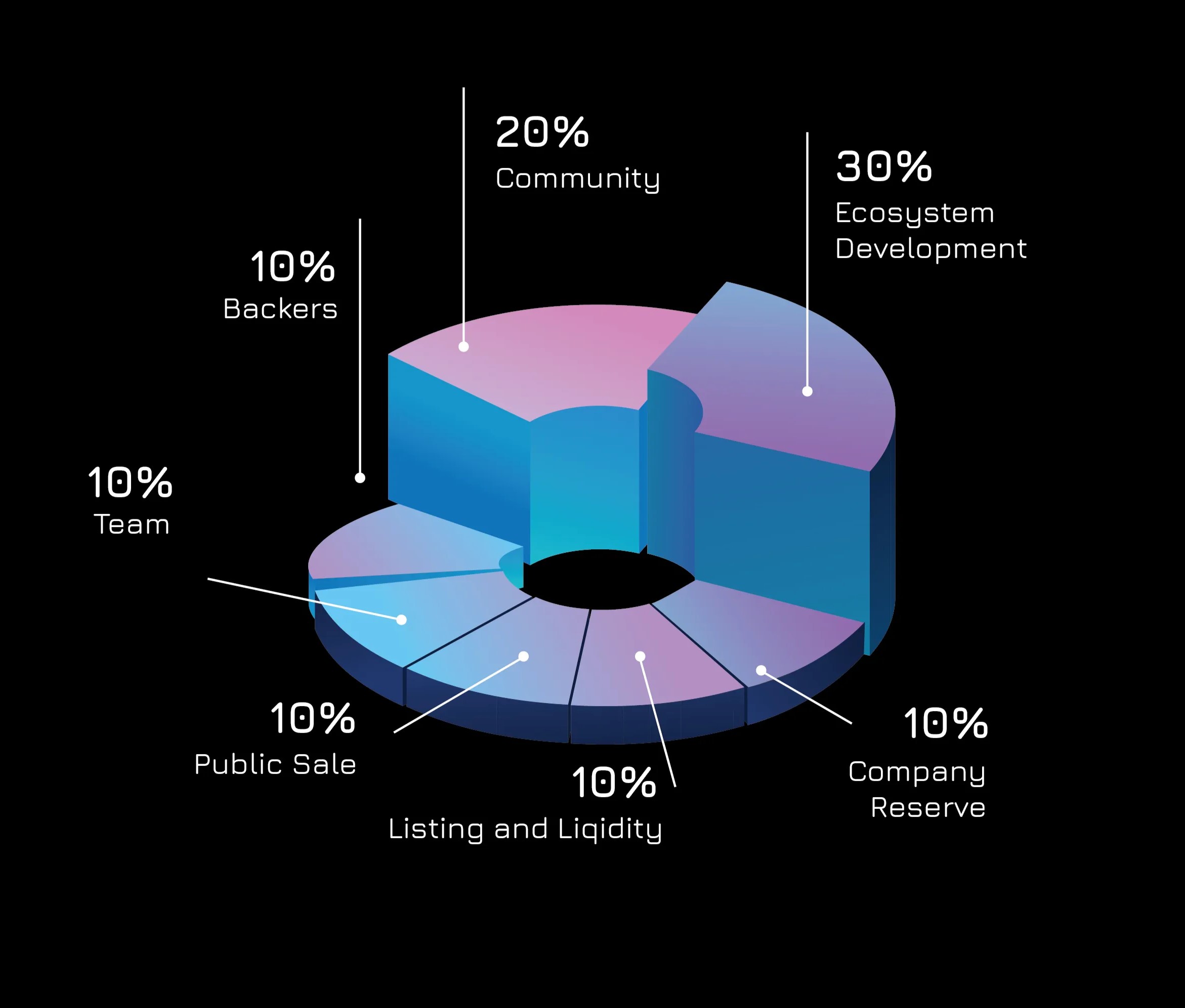

Areon Network's Token Allocation and Vesting Pools

Areon Network has a dedicated token allocation model with clearly defined vesting periods.

| Category | Allocation | AREA | The Unlock / Launch | Cliff / Month | Vesting |

|---|---|---|---|---|---|

| Ecosystem Development | 30% | 75.000.000 | 50% | 12 | 120 Months Linear |

| Community | 20% | 50.000.000 | 60% | 12 | 60 Months Linear |

| Backers | 10% | 25.000.000 | 0% | 12 | 120 Months Linear |

| Team | 10% | 25.000.000 | 0% | 12 | 48 Months Linear |

| Public Sale | 10% | 25.000.000 | 100% | 0 | 0 |

| Listing & Equity | 10% | 25.000.000 | 60% | 12 | 48 Months Linear |

| Company Reserve | 10% | 25.000.000 | 60% | 12 | 72 Months Linear |

| TOTAL | 100% | 250.000.000 | 122.500.000 | = | = |

Our network has a Total Supply of 250 Million.

30% Ecosystem Development:

This signals a sharp focus on the long-term growth of our project. Any new product that will be developed on Areon Chain will be boosted by this decision.

Additionally, an Emergency Fund will be allocated to address any potential attacks that may occur on Areonchain, and it will also be made available to the Areon Team for the operational needs of running validators until they are certain that everything is running smoothly. This allocation has a 120 months linear vesting period. 75 Million coins are locked for this purpose.

20% Community:

This allocation is aimed at community engagement and rewards. As a decentralized project, Areon Network is primarily focused on community development and empowering the broad expanse of our audience.

This allocation has a 60 months linear vesting period with 50 Million coins locked.

10% Backers:

For the major supporters and investors of the project that will be decided by the Areon team, keeping in mind the best interest of the project.

This allocation has a 120 months linear vesting period with 25 Million coins locked.

10% Team:

The share of the Areon team, locked away for a predefined period until the project matures.

The allocation for this purpose is 48 months and with a total of 25 Million vested coins.

10% Public Sales:

There is no locked duration for this item which is worth 25 Million AREA coins.

10% Listing & Liquidity:

We set aside another 25 Million AREA coins for listing expenses and liquidity purposes.

It is important to note that Areon Network is extremely careful when selecting listing and partnership offers. We carefully select top tier exchanges for our project for negotiations.

The vesting period is 48 months.

10% Company Reserve:

The final item on our token distribution scheme. 25 Million AREAs are locked and set aside for a 72-months period as company reserves.

Our Deflationary Approach

With Areonchain, we will have a total supply of 250 million AREA. Thanks to its excellent deflationary mechanism, burning will occur on the last day of each quarter, a total of 4 times a year. The burning will be directly proportional to the transactions on Areonchain. This algorithm will continue to operate until the total supply reaches 100 million AREA.

Our goal is to maintain and uphold a fair value for AREA, so that we can look out for the best interest of our small time investors.

By taking a stance against inflation in our chain, we will effectively combat selling pressure for the long-term and focus on developing our chain and products for many years to come.

As an extension of this long-term deflationary strategy, we expect Areonchain to reach a total supply of 100 million AREA within 10 years.